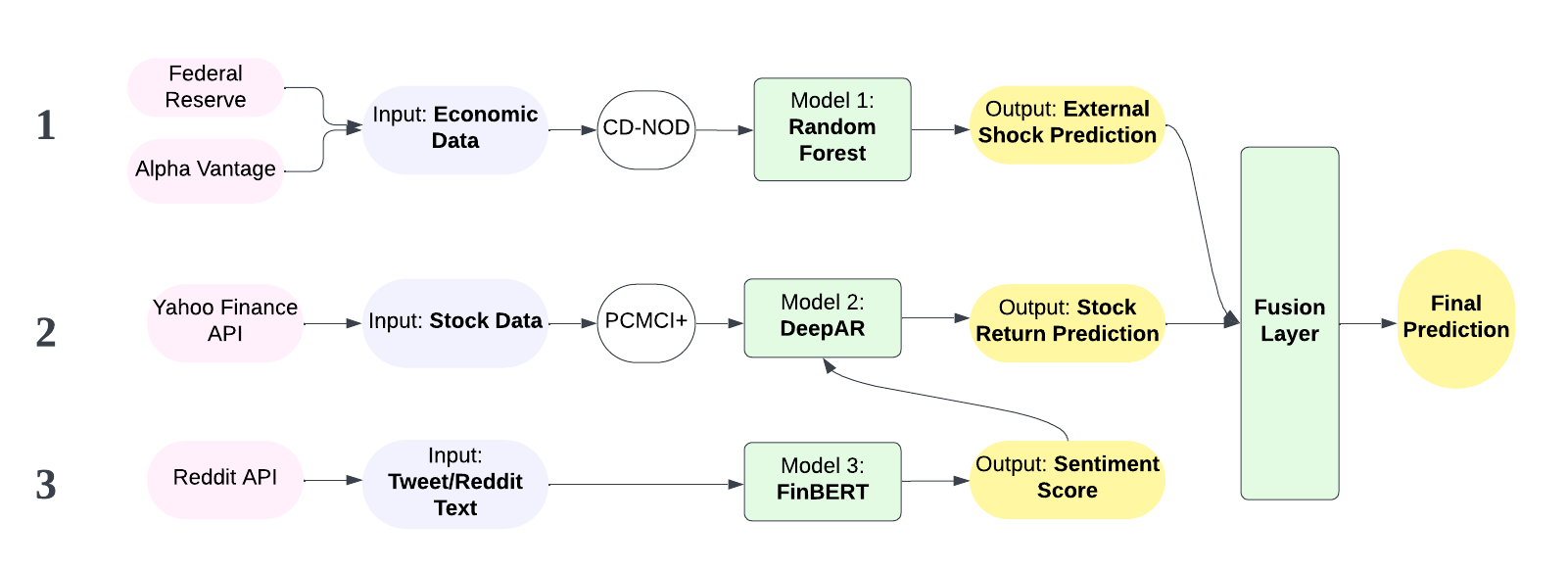

Stock Return Prediction Module

Our stock prediction system is designed to model uncertainty in the market. Unlike traditional models that only

provide a single prediction, we generate a range of possible outcomes with their probabilities - similar to how

experienced investors think about market risks.

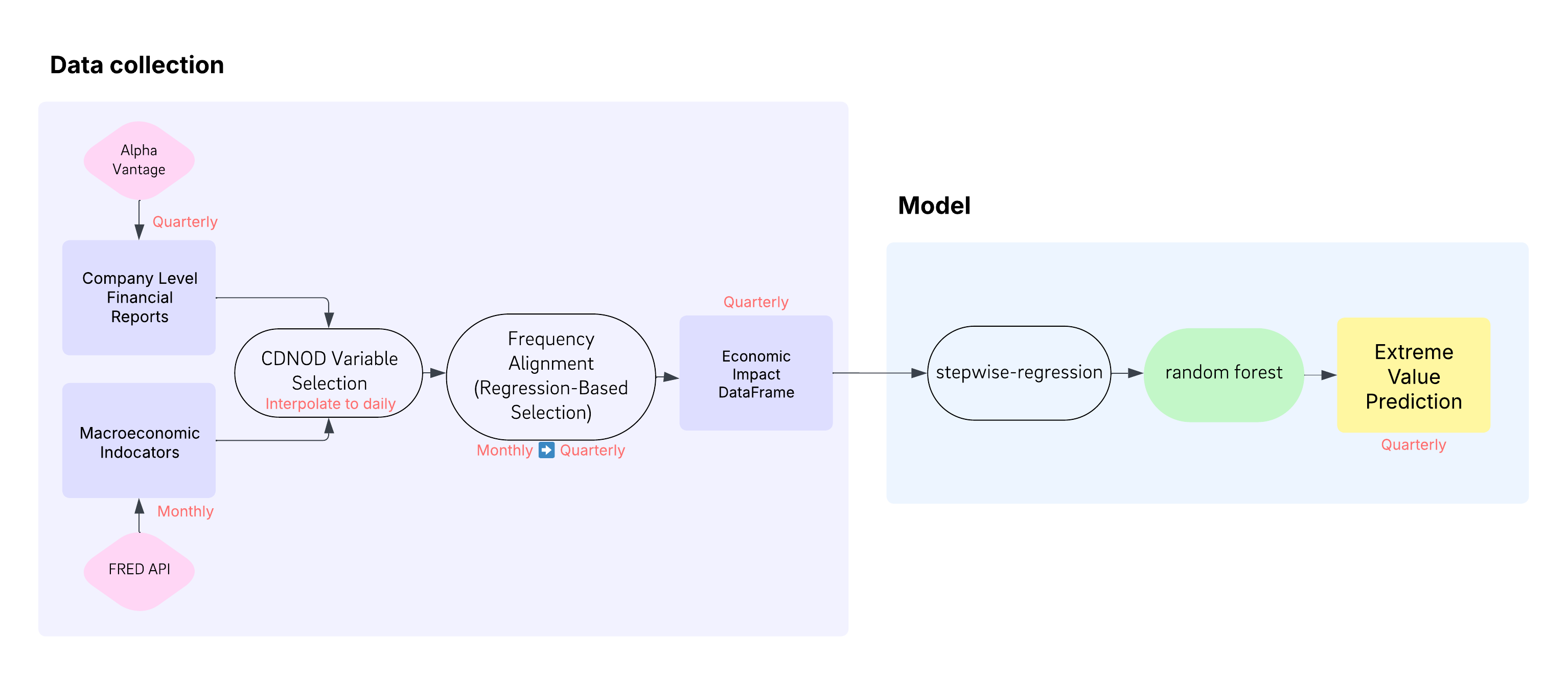

Data Collection & Pre-processing

We collect historical data of 6 companies (3 Tech, 3 Healthcare) via Yahoo Finance API

from Jun 2020 to Feb 2025, including daily metrics of opening/closing price, high, low, and volume. Our dataset contains

1,190 trading days per company, totaling 7,140 records, capturing both stable and volatile market periods. We calculate Daily return as:

Rt = (Pt - Pt-1) / Pt-1

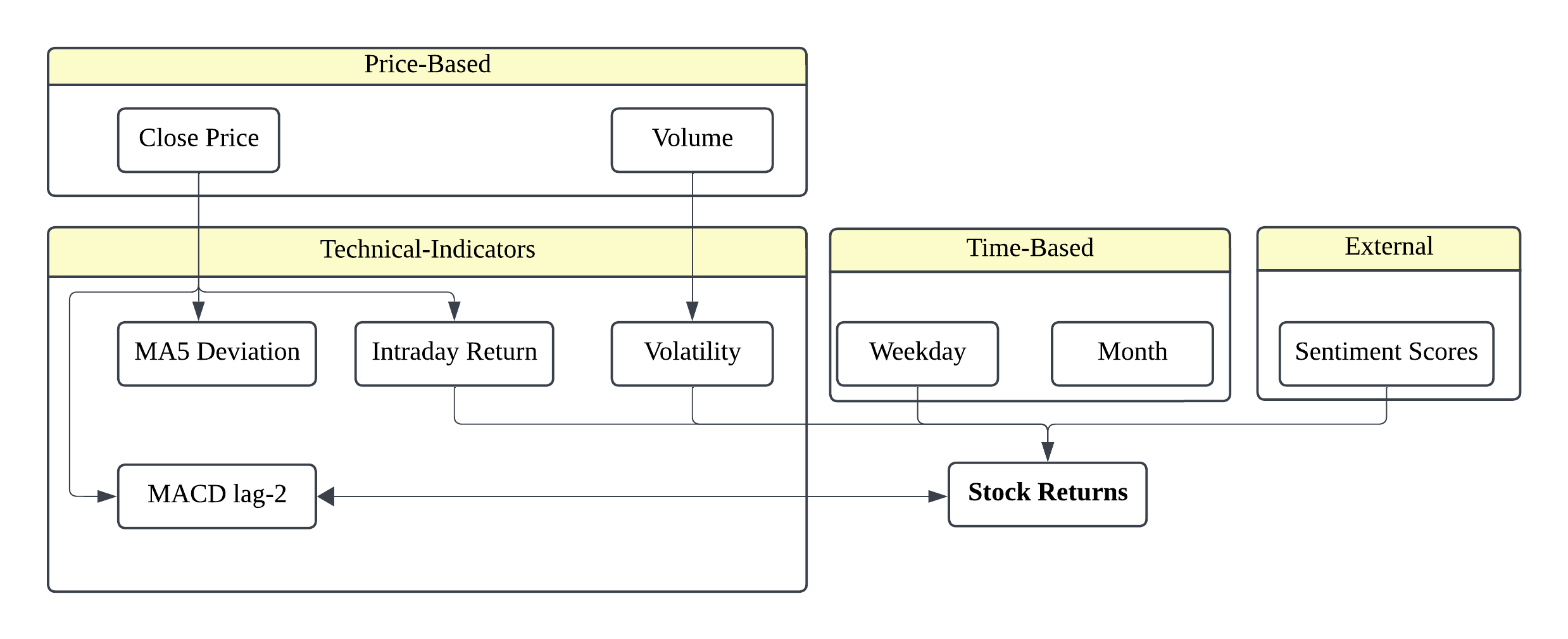

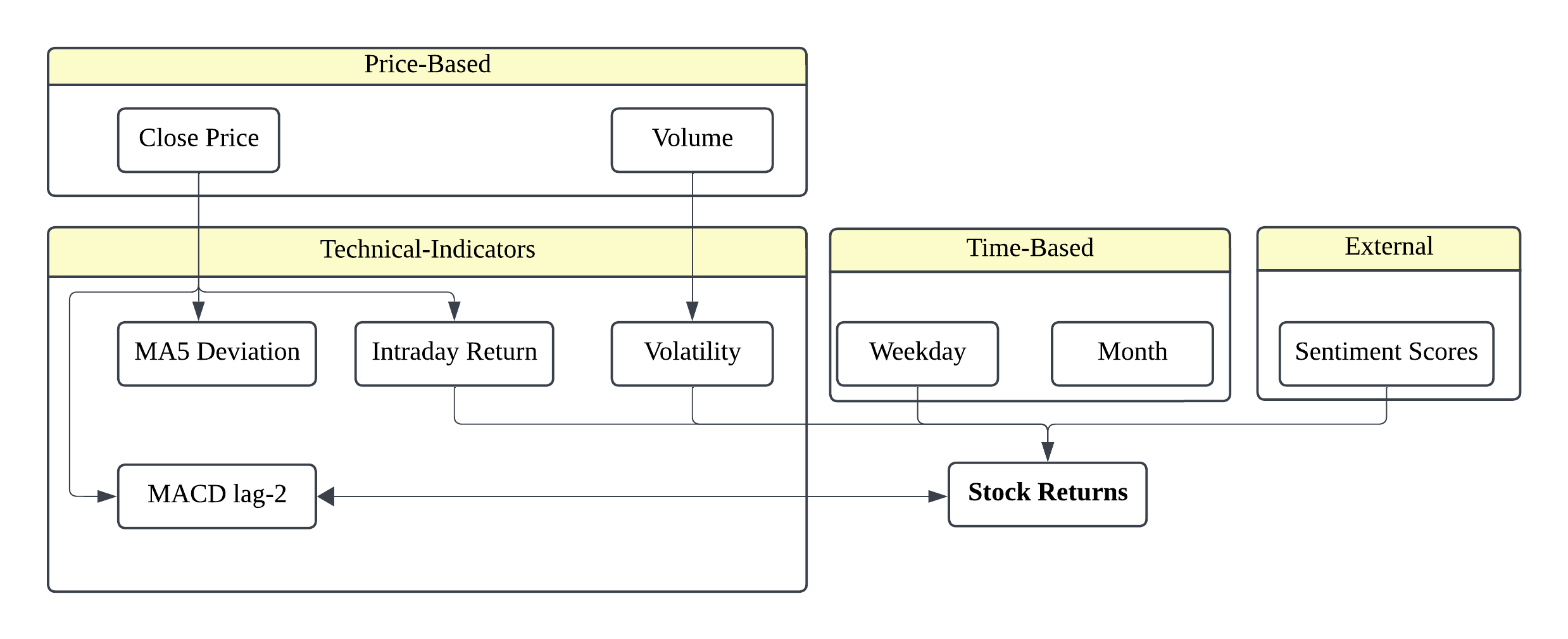

Causal Feature Selection

Applied PCMCI+ algorithm for causal feature selection, identifying 8 key covariates based on their causal impacts.

This advanced technique helps us distinguish true causal relationships from mere correlations, focusing on factors that actually drive stock returns:

- Price-Based Features: Close price and trading volume

- Technical Indicators: MA5 deviation, MACD with lag-2, intraday returns, volatility measures

- Time-Based Features: Calendar effects (weekday and month patterns)

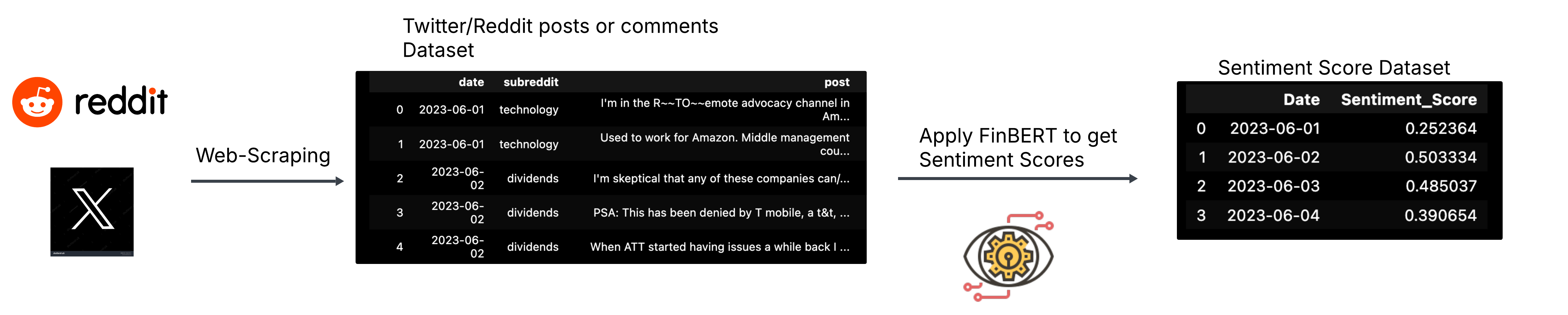

- External Features: Sentiment scores from market news and social media

The causal structure above shows which factors truly influence stock returns, with stronger connections indicating stronger causal effects

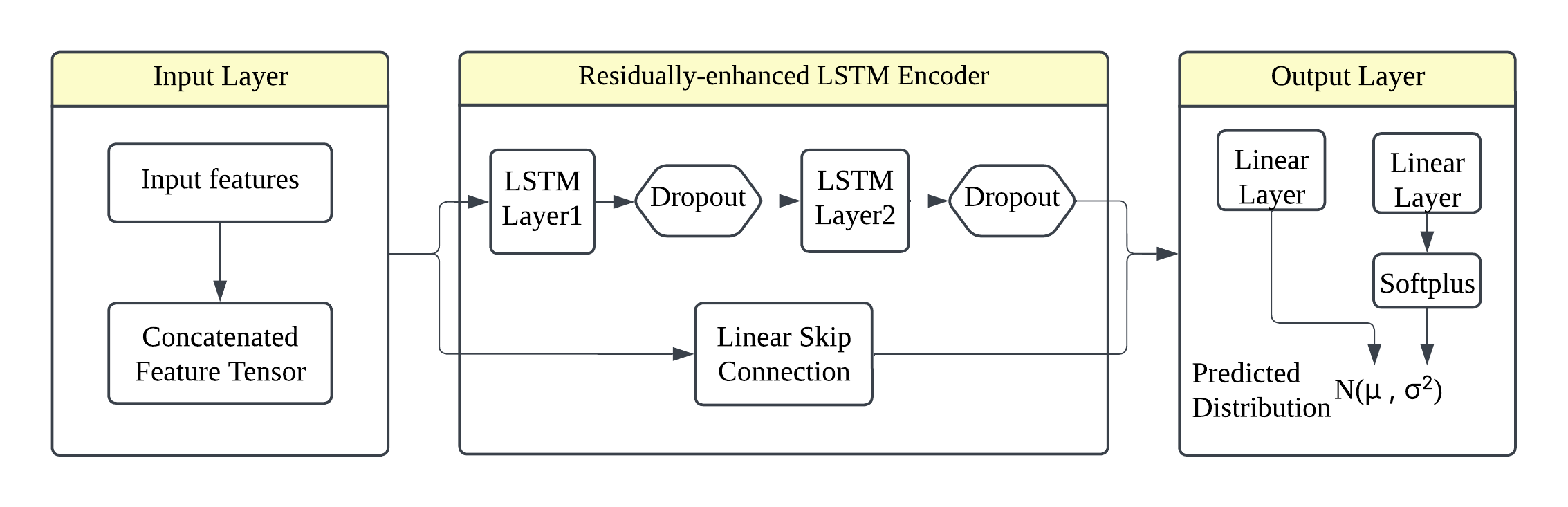

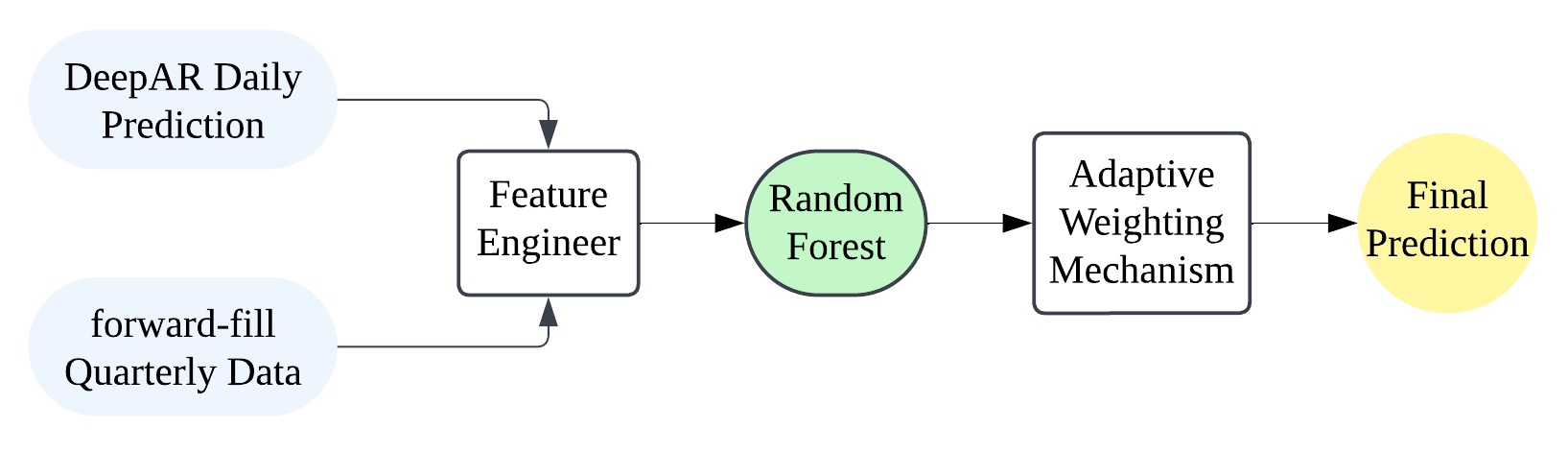

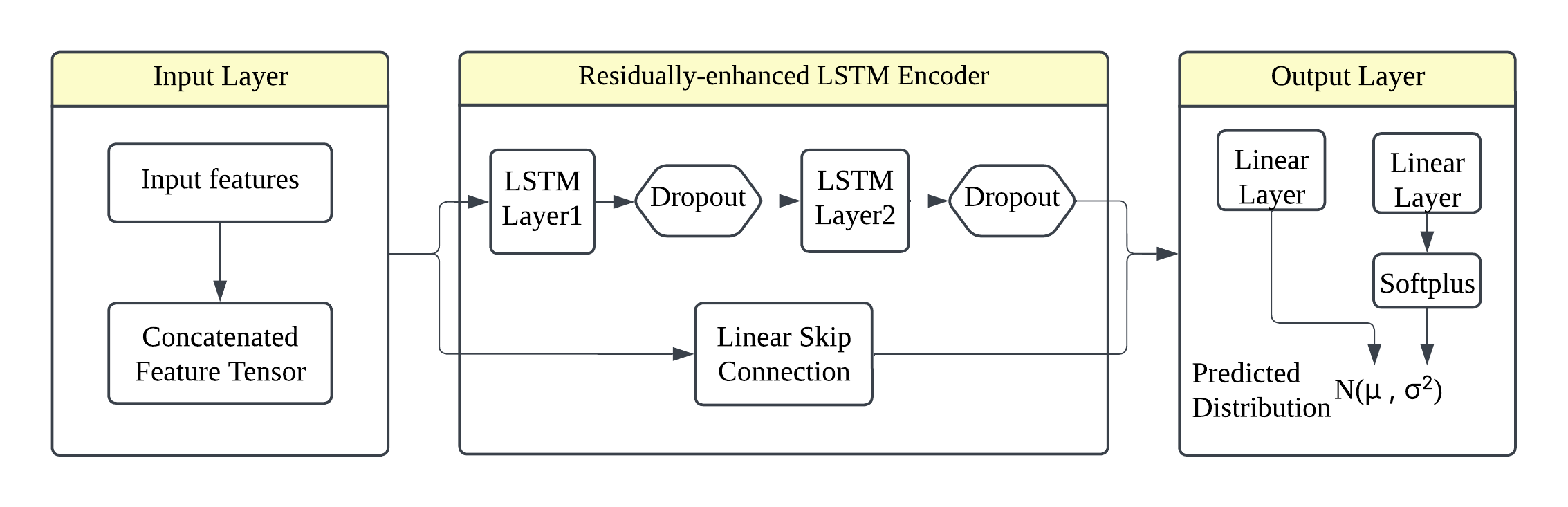

Model Architecture

Our model is based on the DeepAR (Deep Auto-Regressive) architecture, which combines deep learning with probabilistic forecasting.

This approach is particularly well-suited for financial time series where uncertainty quantification is crucial.

The model integrates historical returns, technical indicators, and entity embeddings into a concatenated

input tensor. An enhanced LSTM with skip connections and variational dropout enables robust gradient flow.

The probabilistic output layer generates a Gaussian distribution of future returns, instead of just point estimates.

Key improvements in our architecture include:

- Orthogonal Weight Initialization: Ensures stable gradient flow during training

- Variational Dropout (15%): Prevents overfitting while preserving time series patterns

- Skip Connections: Allow the model to leverage both raw and processed features

- Hierarchical Structure: Captures both short-term fluctuations and long-term trends

The model processes historical data through specialized layers to produce probability distributions of future returns